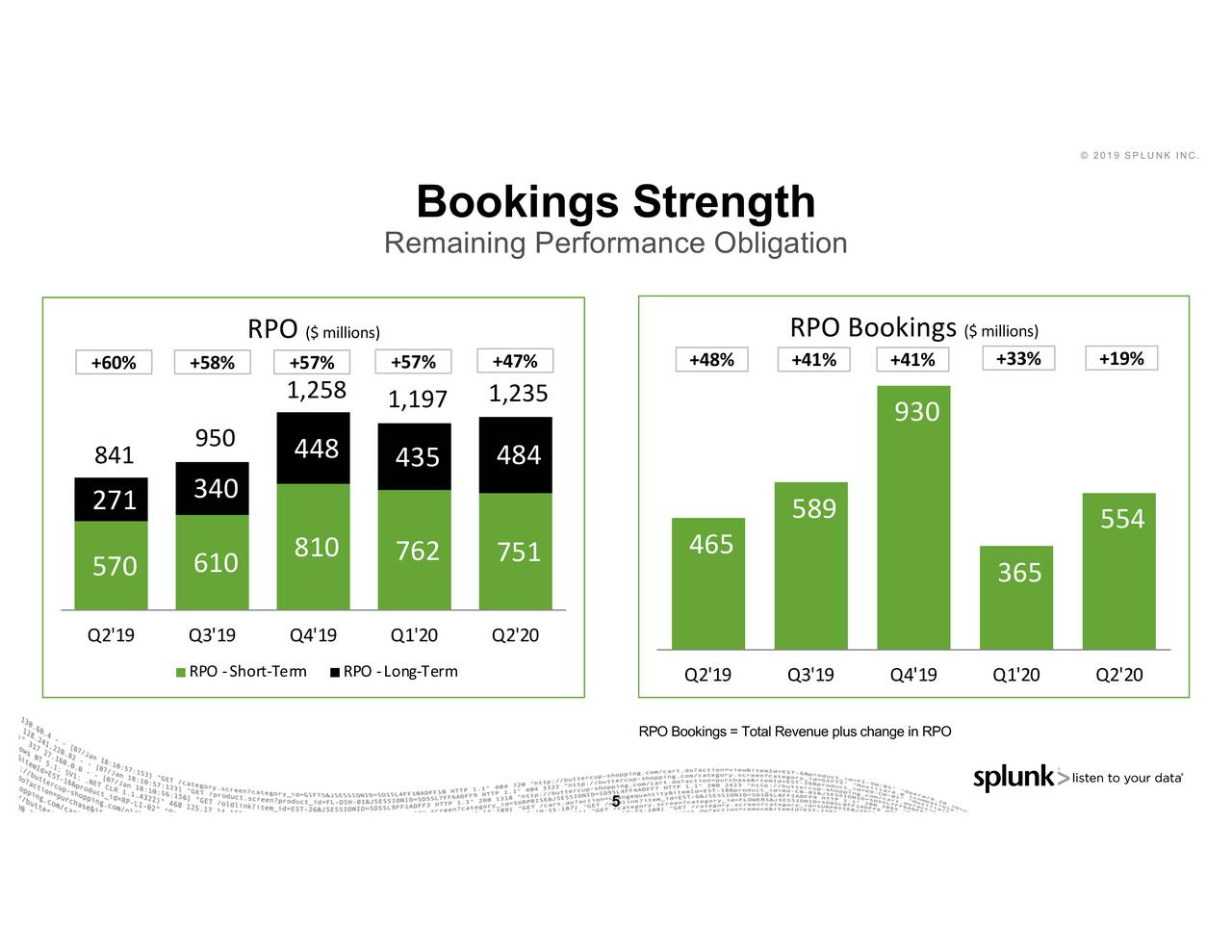

Customers paying more than 1 million dollars for Splunk’s service increased 44% in FY 2021, and Splunk’s cloud ARR (annually recurring revenue) rose 83% while total ARR was up 41%. In a few months, investors will realize that Splunk’s decision to switch to the SaaS model was a great transition for the company.Īlso, Splunk’s subscription business is growing at an exponential speed. Look closely after 2021, Splunk’s revenue is estimated to grow and accelerate again thus, since Splunk is about to report their 2022 Q1 earnings report, I believe Splunk’s decline is nearly over. The yearly revenue decreased from FY 2020 to 2021 because of the transition phase. Why do I think the transition is almost over? Once, the transition is complete, investors will start seeing annual revenues grow again, and the stock, most likely, will rebound (SaaS companies are valued higher than other companies as well). Thus, a short-term decline in revenue is actually a great thing for the company. However, the company is being paid regularly allowing Splunk to easily increase the duration of the contracts, increase the subscription fee, and sell more services. Splunk may seem like they are struggling because they are not receiving a one-time big payment from their customers. However, for investors who are seeking long-term opportunities, the recent decline in share prices is only creating more opportunities because switching to a SaaS business model is clearly not a bad decision. If one is looking at the company from a short-term perspective, this might be bad news. Many bears or skeptics pointed out that Splunk’s transition into a SaaS company is causing the company's growth and current revenue to decline. Thus, it is very clear that Splunk is in a position to benefit from this growing industry. The industry clearly is growing fast at about 40% during these 3 years. Splunk’s management revealed their TAM, which is increasing from 81 billion dollars in 2020 to 114 billion dollars in 2023. After all, more and more valuable data is created each passing day. Imagine the possibilities Splunk has as more companies from all different industries realize the importance of utilizing their data.

I can go on and on discussing why data is important in a pizza business. For example, Domino will need to know how much each customer spent on average making their custom pizza, or the average amount of tip that customers gave to delivery personals for different delivery times. This might sound simple but numerous data need to be utilized behind the scene. Domino figured out what ingredients customers preferred and what kind of experience their customers wanted when ordering.

Splk seeking alpha software#

Companies like Domino's ( DPZ) utilized their data using Splunk’s software to become the most successful and innovative pizza chain in the world. Tech giants are not the only companies that are utilizing data. Thus, I can reasonably argue that data is becoming the oil of the 21st century. Like these examples, data is extremely valuable in fact, it is enough to create one of the biggest conglomerates in the modern world.

Splk seeking alpha for free#

We are using Google ( GOOG ) for free by providing Google with our search data. For example, we are using Facebook’s (FB) social media for free by providing the company with our data. People know that data is extremely valuable.

With the rise of the 4th industrial revolution, data will become the new oil. Since the beginning of the industrial revolution, oil was one of the most important commodities. The current share price of Splunk is extremely undervalued compared to its peer. Shareholders can finally see year-over-year revenues increasing in the next few months.

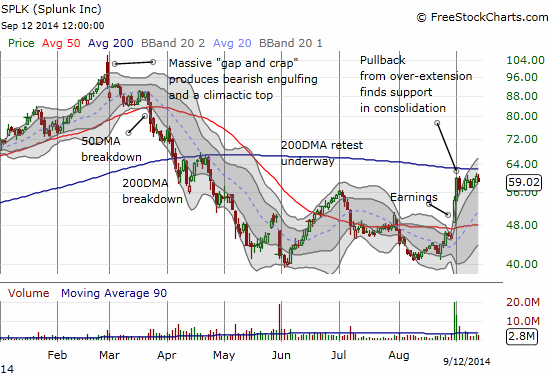

Splunk’s transition from selling licenses to being a SaaS company is nearly complete. However, there were valid reasons behind low guidance and temporary decline in year over year revenue thus, I think the share price of Splunk is in extremely undervalued territory for the following reasons:ĭata is the oil of the 21st century the demand for utilizing ever-increasing amounts of data will create immense opportunities for Splunk. Shares of Splunk ( NASDAQ: SPLK) have been free-falling recently because investors did not like that Splunk’s year-over-year revenue declined and its forward guidance was extremely low. Photo by monsitj/iStock via Getty Images Investment Thesis

0 kommentar(er)

0 kommentar(er)